Features for Treasury Accounting

3 Applications - One Solution

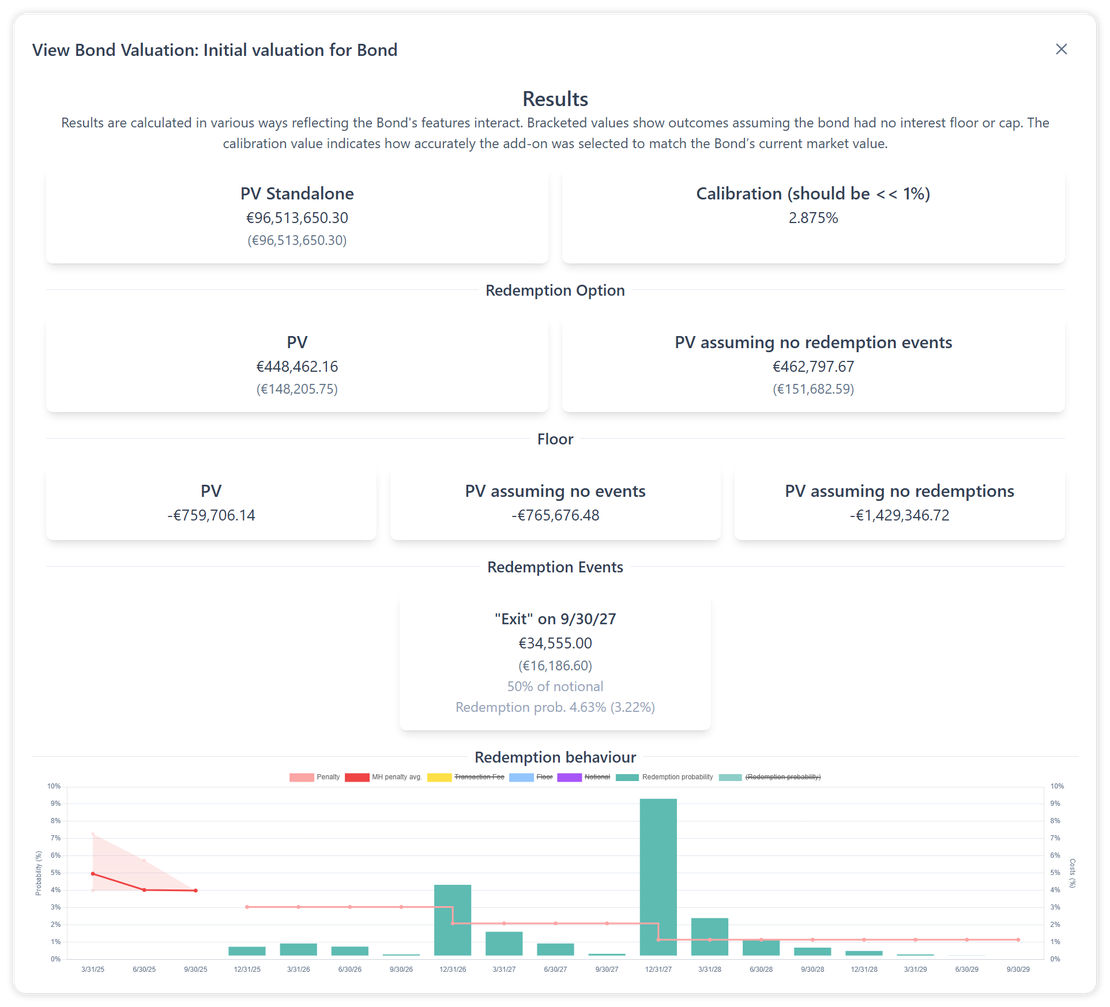

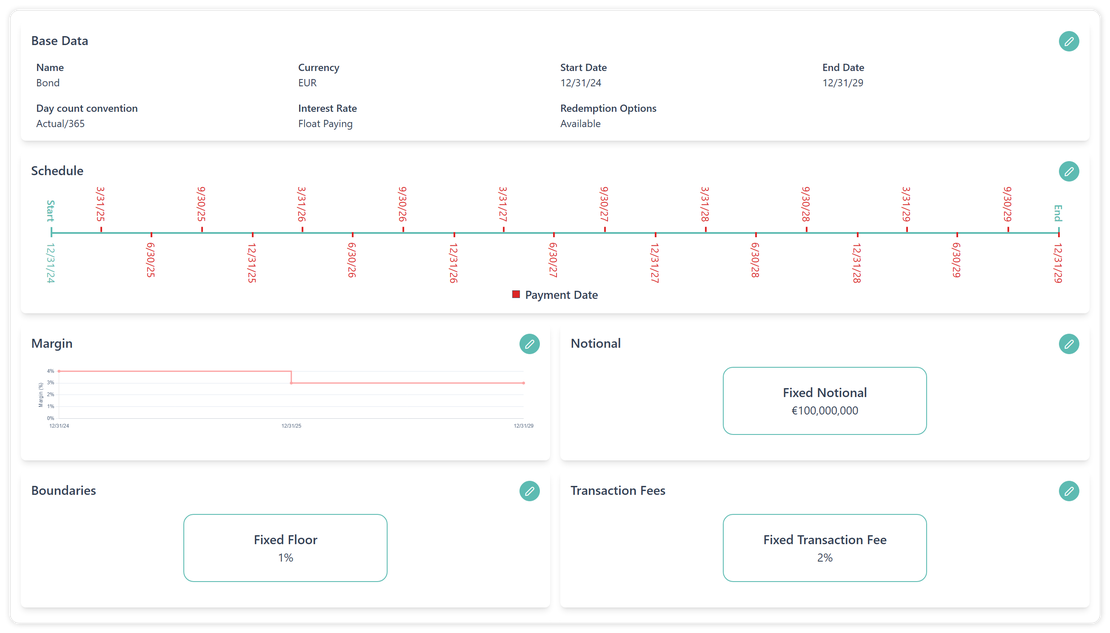

Valuation

Finflexia - your powerful valuation engine

- Deriving Fair Value of standard loans for notes purposes

- Calculating Hedge Fair Value for Hedge Accounting

- Derivative pricing feature

- Deriving fair values for embedded derivatives like redemption options and conversion features

- Fair Value calculation for derivatives like swaps, cap/floors, etc.

- The comprehensive audit log ensures compliance and traceability

- Extended notification functionality keeps you in the loop

Risk Analysis

Sensitivities and cashflow analysis - we got you covered

- Fair Value sensitivities: Gain deep insight into how market movements impact the fair value

- Cashflow sensitivites: Assess how shifts in interest rates, FX, and other variables affect projected cashflows

- From portfolio over instrument to cashflow: Drill down seamlessly from a consolidated portfolio view to individual instruments

- From plain vanilla instruments to complex structures: Manage risk across a wide spectrum of financial products

Reporting

Finflexia - flexible financial instruments reporting

- Design your report the way you want it: Finflexia's reporting tool meets every granularity requirement

- Finflexia's user-friendly audit log ensures full transparency of all changes in each individual module

- Automated journal entry calculation based in accounting category

- Fair Value or effective interest based journal entries

- Automatic generation of relevant notes

- Extended notification functionality keeps you in the loop

Ready to get started?

Discover how Finflexia can streamline your treasury accounting workflows.

Back to Home