Embedded Derivatives

What Are Embedded Derivatives?

Why Embedded Derivatives Are Relevant Under IFRS 9

When bifurcation is required: - The host contract is accounted for separately (for example at amortized cost) - The embedded derivative is measured at fair value - All fair value changes of the embedded derivative are recognized through profit or loss (P&L)

This treatment can introduce significant earnings volatility and increases the need for accurate, market-consistent valuation. As a result, identifying embedded derivatives, assessing whether bifurcation is required, and valuing them correctly is a critical task for treasury and accounting teams.

Under IFRS 9, failure to properly identify and measure embedded derivatives can lead to misstatements, audit findings, and compliance risks. Robust valuation processes and transparent documentation are therefore essential for compliant financial reporting.

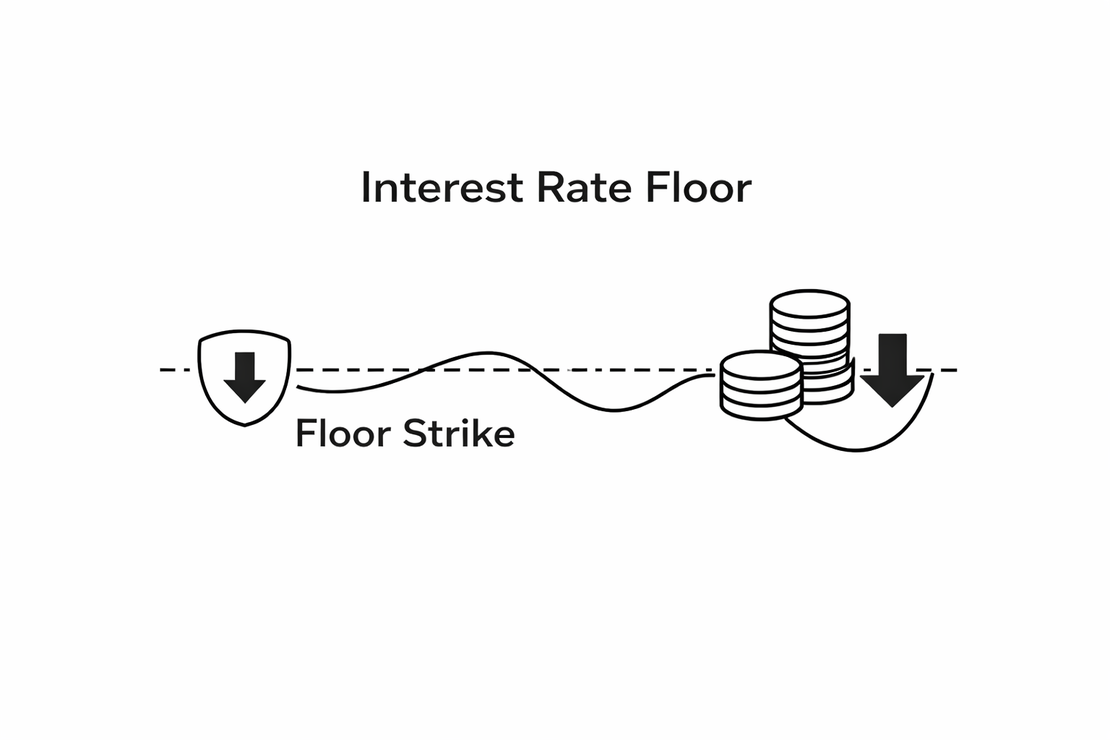

The lower bound for interest payments

An interest rate floor is an embedded derivative that provides protection against declining floating interest rates. It establishes a minimum interest rate (the floor strike) on a variable-rate bond or loan. If the underlying reference rate (such as SOFR or EURIBOR) falls below this strike on an interest payment date, the floor compensates the holder for the difference, calculated on the notional amount. Floors are typically used by investors or lenders to secure a minimum return in low or falling rate environments.

Learn more

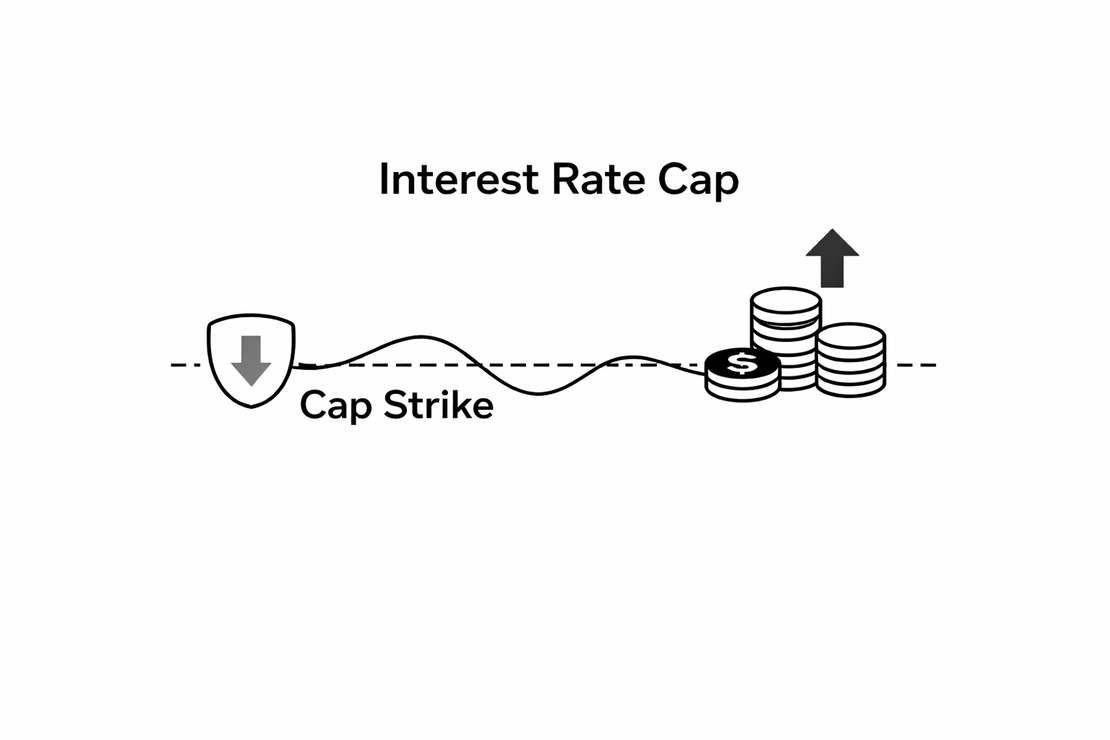

The upper bound for interest payments

An interest rate cap is the opposite payoff profile of an interest rate floor. While a floor protects against rates falling below a minimum level, a cap protects against rates rising above a predefined maximum (the cap strike). If the floating reference rate exceeds the cap strike on an interest payment date, the cap pays out the excess, calculated on the notional amount. Caps are commonly embedded in bonds or loans to limit the borrower's exposure to rising interest rates.

Learn more

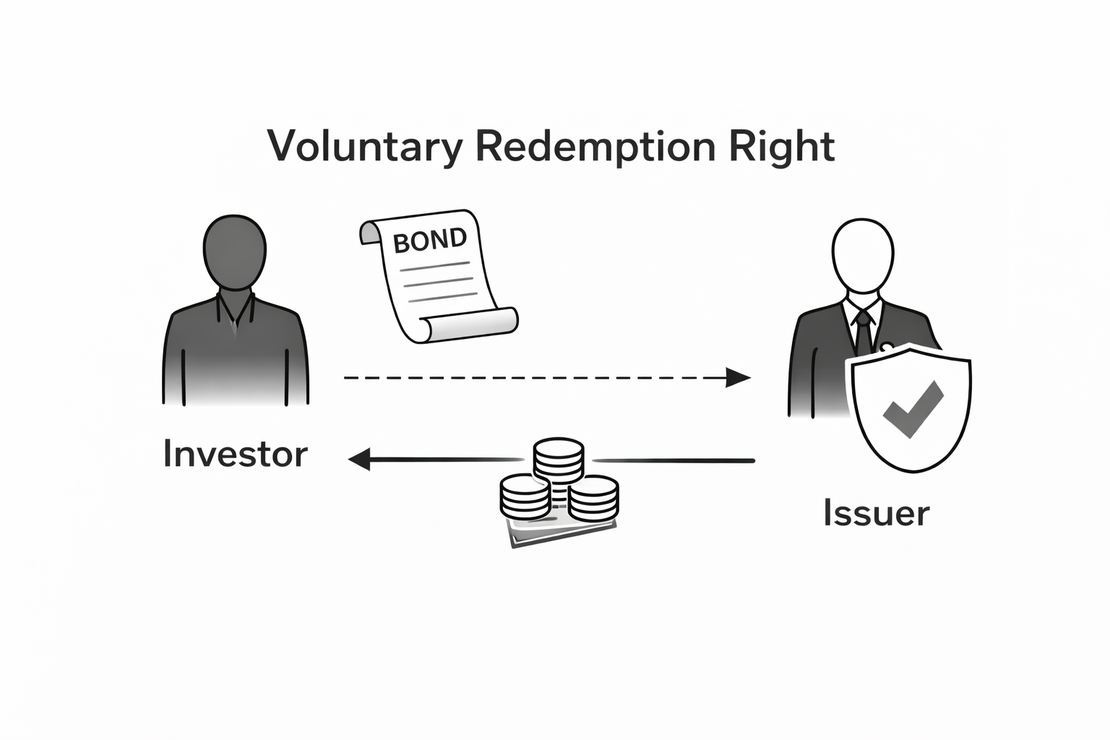

Redemption Rights

The redemption option is included to give the issuer flexibility in managing its debt, primarily to hedge against interest rate risk. The Scenario: When prevailing market interest rates fall significantly below the fixed coupon rate of the outstanding bond, the issuer is paying an above-market interest rate. The Action: The issuer exercises the call option, redeeming the old, high-coupon debt. The Outcome: The issuer then issues a new bond at the current, lower market interest rate, effectively refinancing their debt to lower their periodic interest expense.

Learn more

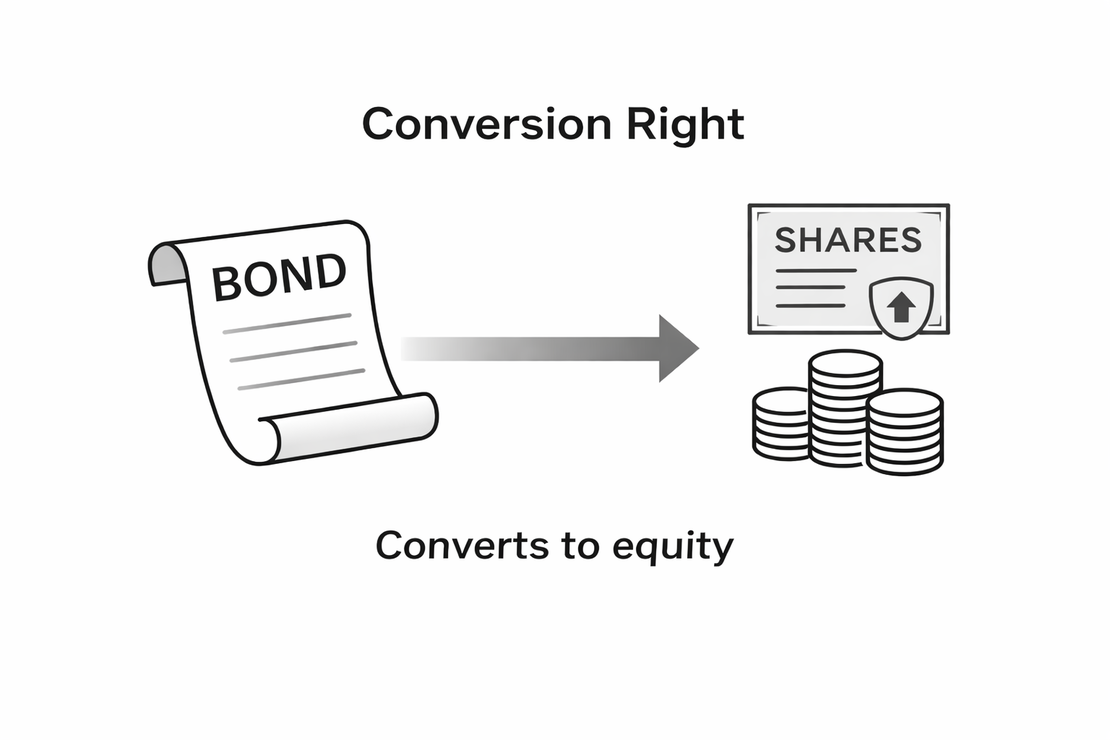

Conversion rights

Conversion rights are embedded derivative features that give the bondholder the option to convert a bond into a predetermined number of equity shares of the issuer under specified conditions. Economically, the conversion right is similar to a call option on the issuer's equity, embedded within the debt instrument. If the issuer's share price rises above the effective conversion price, the bondholder can exercise the conversion right and exchange the bond for equity, benefiting from the upside in the share price. If the share price remains below the conversion price, the bond continues to behave like a standard debt instrument, with regular interest and principal repayment. From a valuation perspective, the conversion right is separated from the host bond and measured as an embedded equity-linked derivative, reflecting factors such as share price, volatility, time to maturity, and conversion terms.

Learn more

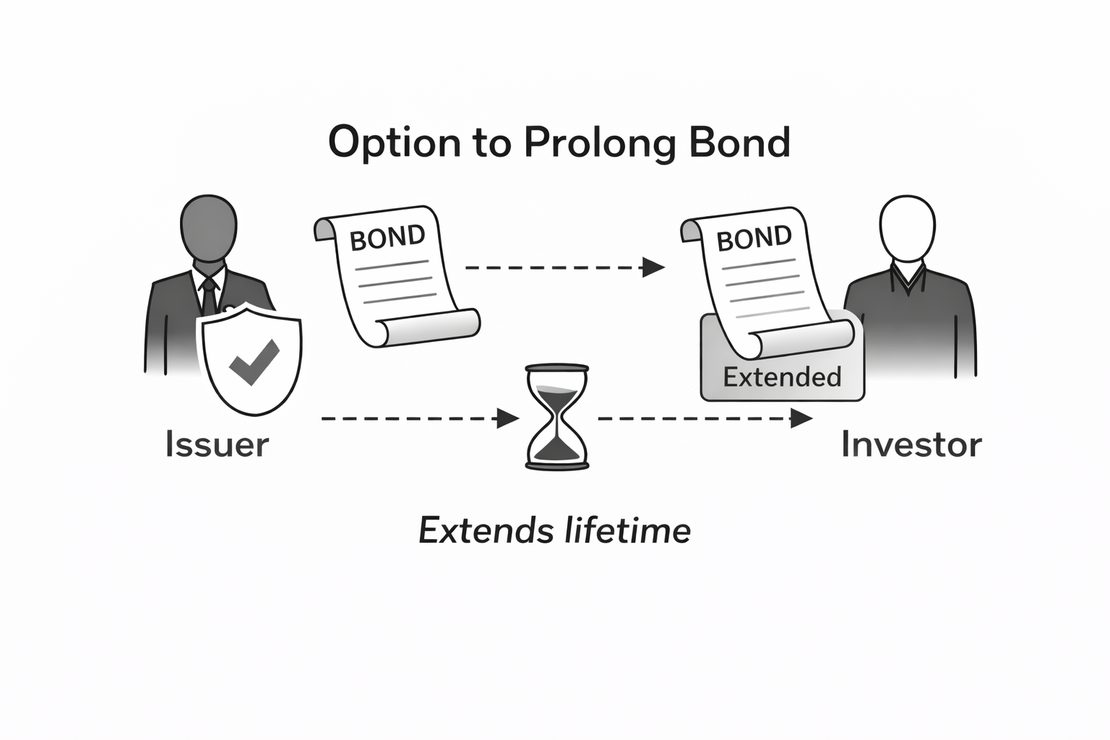

Prolongation Rights

Prolongation rights are embedded derivative features that give one party to a bond—typically the issuer, but in some cases the investor—the right to extend the bond's maturity under predefined terms and conditions. Economically, a prolongation right resembles an interest rate option embedded in the debt instrument, as it allows the exercising party to choose between repayment at the original maturity or continuation of the bond for an additional period. If market conditions at maturity are favorable (for example, interest rates are lower than the bond's coupon), the holder of the prolongation right may choose to extend the bond rather than settle it. If conditions are unfavorable, the bond is redeemed as originally scheduled. For valuation purposes, the prolongation right is separated from the host bond and measured as an embedded derivative, reflecting factors such as the level and volatility of interest rates, the extension terms, and the remaining time to potential exercise.

Learn more

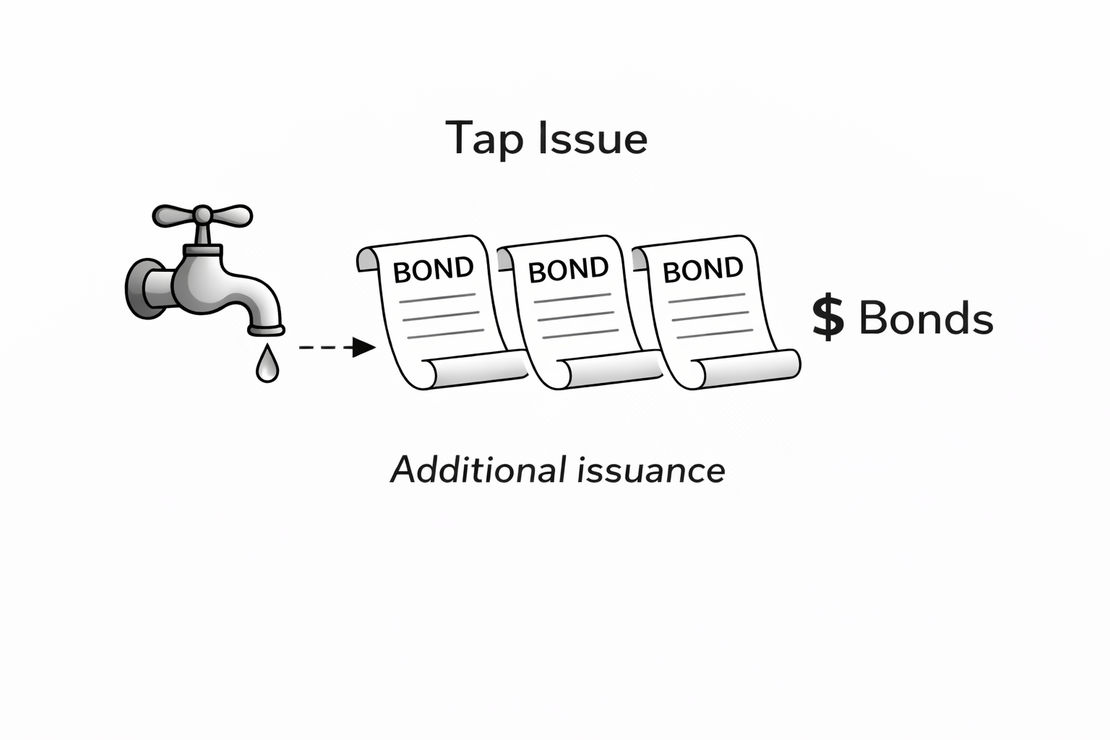

Issue additional notional

Tap issue rights are embedded derivative features that give the issuer the right to increase the notional amount of an existing bond by issuing additional tranches under predefined terms. Economically, a tap issue right resembles an option on future funding conditions, allowing the issuer to raise additional debt under the original bond's framework rather than issuing a new instrument. If market conditions are favorable—such as interest rates or credit spreads being attractive—the issuer may exercise the tap issue right and increase the bond's outstanding notional. If conditions are unfavorable, no additional amount is issued and the bond remains unchanged. From a valuation perspective, the tap issue right is assessed as an embedded derivative, reflecting factors such as interest rate levels, credit spreads, market liquidity, and the specific terms governing the additional issuance.

Learn more

Explore All Embedded Derivatives

Dive deeper into each type of embedded derivative.

Conversion Right

Embedded Conversion Rights in bonds

Learn moreTap Issue

Embedded Tap Issue Rights in Bonds

Learn moreProlongation Right

Embedded Prlongation Rights in bonds

Learn moreEmbedded Redemption Option

Embedded Redemption Rights are common features in bonds

Learn moreInterest Rate Floor

Interest Floors are instruments to hedge exposure against movement in market interest rates

Learn moreInterest Rate Cap

Interest Caps are instruments to hedge exposure against movement in market interest rates

Learn more